Welcome to Kashompa Enterprises

Fast loans, simple process

Welcome To KEL

Our Loans Will Fill Your Dreams Come True

Kashompa Enterprises Ltd (KEL) is a Zambian fintech enterprise committed to advancing financial inclusion through innovative, technology-driven solutions. The company focuses on empowering underserved individuals, micro, small and medium enterprises (MSMEs), and unbanked small-scale businesses by providing accessible, affordable, and reliable financial services.

What We're Offering

Agricultural Finance

MSME Loans

Chilimba Lending

Digital Lending

Our Features

Quick Easy Flexible

Kashompa Enterprises Ltd offers a diverse range of financial products designed to empower individuals, small businesses, and farming communities across Zambia

Lower Rates

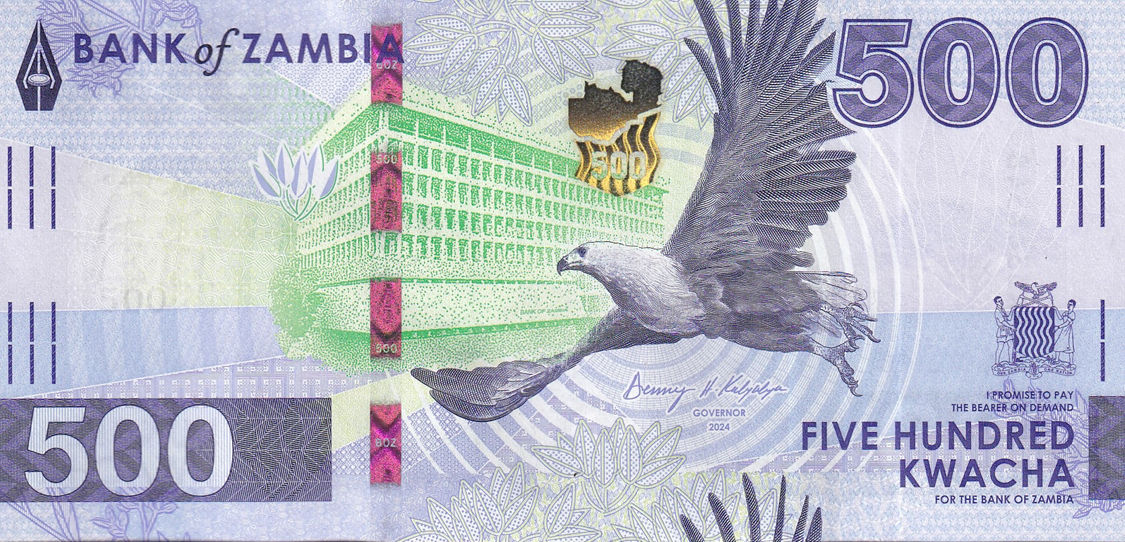

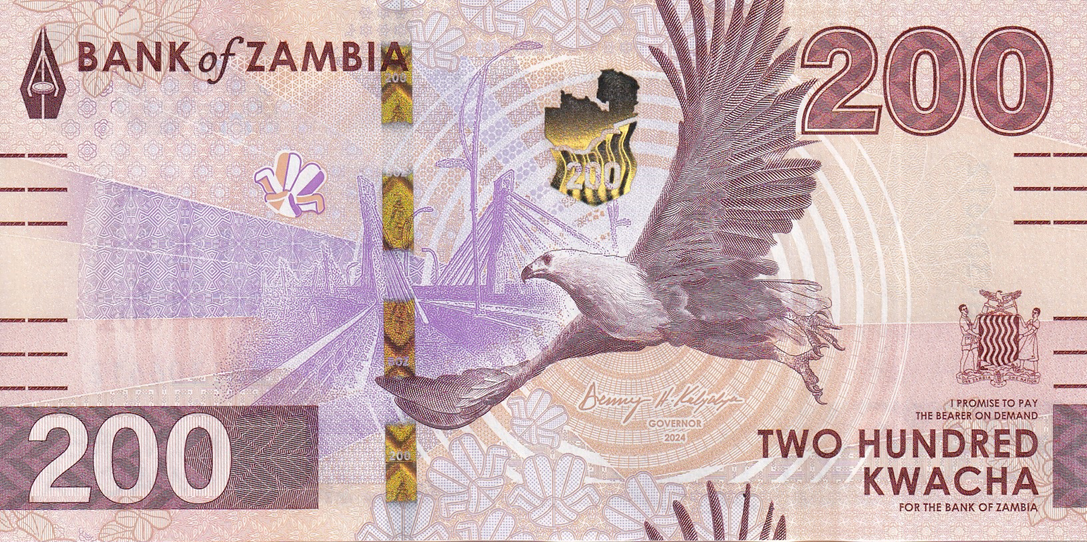

Our rates ZMW are flexible and lower

Quick And Easy

Quick and easy to access

How It Works

Our Working Process

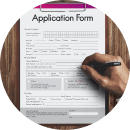

Application Submit

Clients submit a simple digital form with basic business/farming details and NRC documentation. This can be done via mobile or at a rural agent location.

Review & Verification

Our team assesses creditworthiness and reviews business plans to ensure the loan fits the client's capacity.

Loan Approval

Efficiency is priority; approvals are typically issued within 24 hours. A transparent agreement is shared detailing all repayment terms and schedules.

Loan Disbursement

Funds are disbursed directly to the client's mobile money or bank account. This ensures instant access to capital for inventory or agricultural inputs.

Company Transparency

Our Company Core

Value

- Integrity

- Inclusion

- Innovation

- Responsibility

- Partnership

We uphold transparency, honesty, and accountability in every transaction and relationship.

We are committed to serving all Zambians, especially the unbanked and underserved, by removing barriers to financial access

We embrace technology and creativity to design financial solutions that are simple, scalable, and impactful

We lend ethically and sustainably, ensuring our products improve lives without creating financial distress.

We collaborate with communities, agents, regulators, and partners to expand access to finance across Zambia

Call Us Any Time

260 761233586

Faq

Frequently Asked Questions ?

What types of loans are available?

Common types include Agricultural Finance loans, Chilimba loans Digital Lending, loans, and business loans.

How does the loan application process work?

24 hours to process the application if every documentation is in order

What is the interest rate on a loan?

The loan rate can be calculated using our loan calculator found on our website

Download Our App

Start Your Loan

Application With Smartly

Download our mobile application both available on android and IOS coming to stores in January 2026

- Quick Loan Process

- Very Low Rates